pay utah property tax online

Please note that our offices will be closed November 25 and November 26 2021 for the Thanksgiving Holiday Pay over the phone by calling 801-980-3620 Option 1 for real property. Your signed statement of personal property must be physically submitted to the assessor in order to comply with the filing requirements and avoid non-filing penalties and fees.

Free Cash Payment Receipt Template Pdf Word Eforms

Ad Pay Your Taxes Bill Online with doxo.

. Official income tax website for the State of Utah with information about filing and paying your Utah income taxes and your income tax refund. 245 for Discover Visa Master Card. Nightly scheduled maintenance is done from 1155 PM to 500 AM MST.

Please contact us at 801-297-2200 or taxmasterutahgov for more information. Do not staple your check to your return. Taxpayer Access Point Utahs Tax Portal File pay manage your Utah taxes online.

Filing Information Free Paid Tax Software Websites. These are the payment deadlines. Paid online or by phone with a receipt transaction time before midnight Mountain Standard Time on November 30th.

The various taxes and fees assessed by the DMV include but are not limited to the following. Property taxes help to pay for a variety of public services. Click here to pay via eCheck Credit Card Payments Property taxes can be paid online by credit card.

Please call 435-636-3248 if you do not know your number To Contact the Assessors Office in person or via mail. Scheduled maintenance times are approximate and may be extended due to unusual circumstances. Payments by credit card may be made either online at taputahgov or over the phone by calling 801-297-7703 800-662-4335 ext.

Remove any check stub before sending. This section discusses methods for filing and paying your taxes including how to file onlinethe fastest and safest way to file. Use the menu for information on specific topics.

Follow the instructions at taputahgov. See Payment Alternatives for more information about different methods of payment. 7703 The Utah State Tax Commission accepts Visa MasterCard Discover Card and American Express credit cards.

Founded in 1850 Weber County occupies a stretch of the Wasatch Front part of the eastern shores of the Great Salt Lake and much of the. A convenience fee is charged for payments by credit card. To pay Real Property Taxes.

Pub 2 Utah Taxpayer Bill of Rights contains additional information regarding taxpayer rights and responsibilities. Please click on each item for more information. Assessor - Personal Property Tax Payments.

320 for AMEX. Registration Fees Utah Code 41-1a-1206 and others. You may also pay with an electronic funds transfer by ACH credit.

Before continuing please make sure that you have the following information readily available. Checks are to be made payable to Utah County Treasurer and can be written for the tax amount only. Rememberyou can file early then pay any amount you owe by this years due date.

We cannot return cash for checks in excess. This section discusses information regarding paying your Utah income taxes. Please be advised our web site may be occasionally unreachable due to file maintenance.

An electronic check payment or e-check has no fee. Here you can pay your personal property taxes. Online payments do not satisfy the filing requirements as stated in UCA 59-2-307.

Salt Lake County Property Tax Notice. How Do I Pay My Property Taxes In Utah. Weber County property taxes must be brought in to our office by 5 pm.

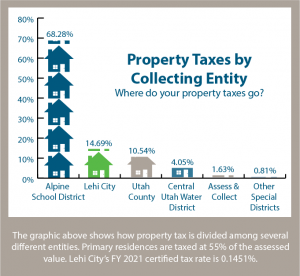

In Utah additional property tax revenue is not a simple matter of raising property values to increase revenue. We will not accept a third party check. Assuming everything else remains equal an increase in property value would mean a decrease in the tax.

What you need to pay online. INDIVIDUAL INCOME TAXES BUSINESS CORPORATE TAXES SALES USE TAXES WITHHOLDING TAXES FUEL TAXES CIGARETTE TOBACCO TAXES MOTOR VEHICLE TAXES FEES PROPERTY TAXES TAX INSTRUCTION TRAINING LISTING OF ALL TAXES FEES TAX PROFESSIONALS PUBLIC. Please note that for security reasons Taxpayer Access Point is not available in most countries outside the United States.

Instant Payments charges a 049 CONVENIENCE FEE for each transaction no matter what amount is paid. Rather the base property tax revenue is the same from the prior year. Utah Tax Recordkeeping Responsibilities US.

Salt Lake County Treasurer. Pay by Mail You may also mail your check or money order payable to the Utah State Tax Commission with your return. The link will take you to the pay portal in the County Assessors Office.

On November 30 or 2. You will need to enter your 8 digit UPP number to gain access. Carbon County Assessor 751 E 100 N Suite 1200.

Taxpayers paying online receive immediate confirmation of. You can also pay online and avoid the hassles of mailing in a check. Classification Guide PDF Version.

Credit Cards If a credit card is used as the method of payment the following convenience fees apply. Pay your Business Personal Property Taxes Please contact the Assessors Office at 801-399-8572 if you have any questions. Please note that for security reasons Taxpayer Access Point is not available in most countries outside the United States.

Payments are accepted with a personal check the account holders name and address must be pre-printed cash or cashiers check travelers checks and money orders. Be Postmarked on or before November 30 2022 by the United States Postal Service or 3. Print Steps to Pay your Property Tax Page Print Terms Conditions Page Step 1 - Online Property Tax Payments Salt Lake County hopes that you find paying your property taxes online a quick and simple process.

Pay directly to the Utah County Treasurer located at 100 E Center Street Suite 1200 main floor Provo UT. This website is not available during scheduled system maintenance. Online payments may include a service fee.

This web site allows you to pay your Utah County Personal Property Taxes online using credit cards debit cards or electronic checks. No convenience fee is charged when you pay with an e-check. We accept Visa MasterCard Discover and American Express.

Write your daytime phone number and 2021 TC-40 on your check. Call 877 690-3729 code 5450 to pay your property taxes by telephone. The Personal Property Team within the Property Tax Division develops depreciation schedules used by assessors in the valuation of personal property.

Form of Payment Payment Types Accepted Online. Treasury Offset Program A convenience fee is charged when you pay your taxes using a credit card. Please contact us at 801-297-2200 or taxmasterutahgov for more information.

To find out the amount of all taxes and fees for your particular vehicle please call the DMV at 801 297-7780 or 1-800-DMV-UTAH 800-368-8824. Classification Guide Tabular Data. Official site of the Property Tax Division of the Utah State Tax Commission with information about property taxes in Utah.

They conduct audits of personal property accounts in cooperation with county assessors statewide.

Utah Sales Tax Small Business Guide Truic

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Property Taxes By State Quicken Loans

Payment Options Washington County Of Utah

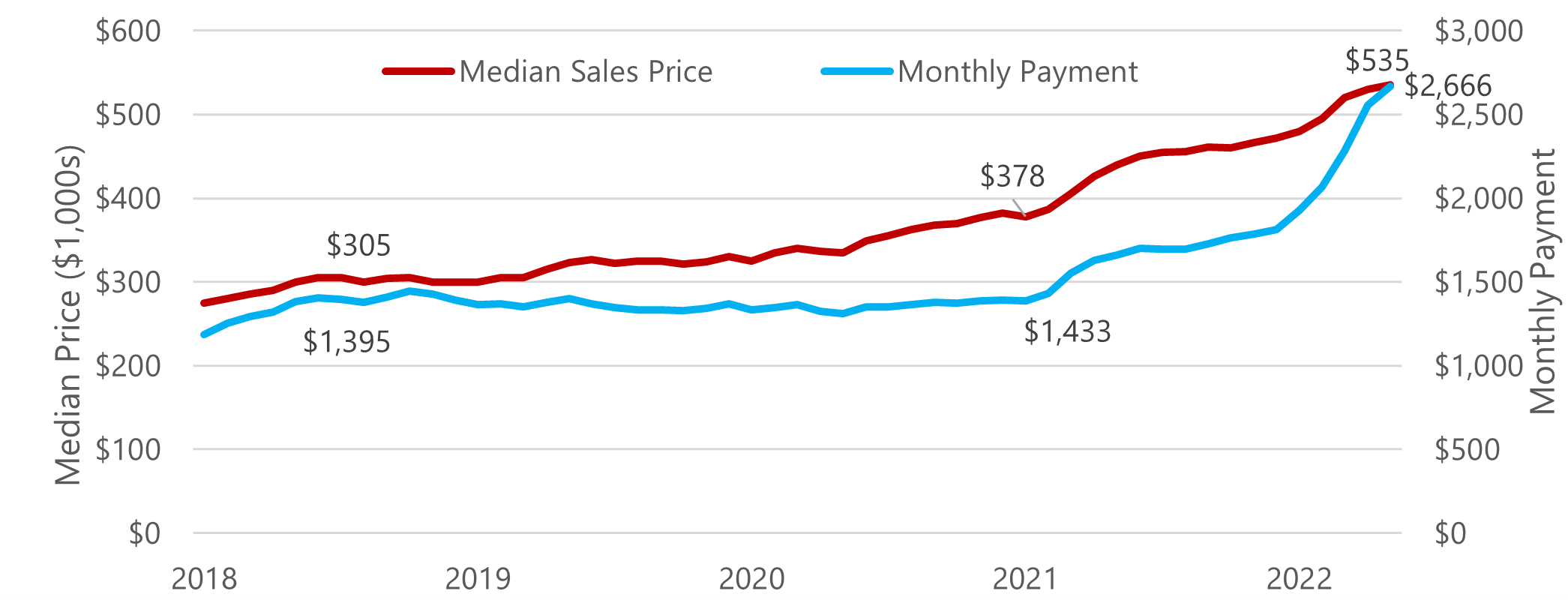

Blog Where Does Utah S Housing Market Go From Here Kem C Gardner Policy Institute

Utah Property Taxes Utah State Tax Commission

Utah Property Tax Calculator Smartasset

Utah State Tax Commission Notice Of Change Sample 1

Pay Taxes Utah County Treasurer

Pay Taxes Utah County Treasurer

Utah Tax Break Program Could Be A Lifeline For Seniors

Utah Estate Tax Everything You Need To Know Smartasset

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor

Colorado S New Property Tax Relief Bill Won T Actually Cut Taxes El Paso County Assessor Says Subscriber Only Content Gazette Com

Utah Property Tax Calculator Smartasset

Black Families Pay Significantly Higher Property Taxes The Washington Post