cook county parking tax portal

The tax shall be collected from any person who seeks the privilege of occupying space in or upon any parking lot or garage. Pure Life Chiropractic Scottsdale.

Welcome to City of Boston Personal Property Online Filing of the Form of ListState Tax Form 2.

. As you are aware the Cook County Department of Revenue has stepped up its enforcement of the Parking Lot and Garage Operations TaxAdditionally it appears the Department has expanded its interpretation of the Ordinance and is imposing the tax. If an entity owns and operates more than one location subject to Cook County Hotel Accommodations Tax please submit the additional site list along with the registration. The Senior Citizen Real Estate Tax Deferral Program.

New Life Christian Academy Fayetteville Nc. 20 for daily parking on the weekends. You must create an online portal profile before being able to file tax returns remit tax due submit service requests etc.

Countywide Parking Spaces for Reserved and Self Park County Owned Vehicles. 20 of the gross amount of consideration received by a valet parking business in connection with its valet parking operations in the city including all related service fees or similar charges. 22 for daily parking during the week as well as all weekly and monthly parking.

The Cook County Parking Lot and Garage Operations Tax Section 74-510 74-549 allows for a tax imposed upon the use and privilege of parking a motor vehicle in or upon any parking lot or garage in the County. The Tax Title division assists with the Citys collection of property taxes on behalf of the Collector-Treasurers Office. Search to see a 5-year history of the original tax amounts billed for a PIN.

1001COUNTYWIDE Transportation and Storage and Mail Services Download List. 20 for daily parking during the week as well as all weekly and monthly parking. Seasonal Road Weight Limits Highway.

Hotel Accommodations Tax Return Please use the registration form to register for the Cook County Hotel Accommodations Tax this form can also be used to register for other Cook County home rules taxes. Request information of incidents charges and details from state and local police departments. The Cook County Property Tax Portal created and maintained by the Cook County Treasurers Office consolidates information from the elected officials who take part in the property tax system and delivers Cook County taxpayers a one-stop customer service website.

Italian Restaurant Santa Barbara Blvd Naples Fl. Property Tax Relief for Military Personnel. The Cook County Treasurers Office provides payment status for current tax years and the ability to pay online.

Freedom of Information Requests. Commissioners approved a 6 percent tax rate for daily parking and a 9 percent rate for weekly and monthly parking. Freedom of Information Act FOIA Request.

22 for daily parking during the week as well as all weekly and monthly parking. Maria Pappas Cook County Treasurers Resume. The Office of the Legal Advisor to BPS functions as in-house counsel providing representation and advice to the Boston School Committee Superintendent and School Department.

Cook County Use Tax Portal. This unique 14-digit sequence number is assigned to the legal description for each piece of real estate in Cook County including vacant lots parking spaces and condominium common areas. Calculate the cost of a building permit.

Billed Amounts Tax History. Taxes and a variety of fees collected by the Cook County Department of Revenue are alcoholic beverages amusement cigarette gasoline and diesel fuel new motor vehicle parking use and wheel taxes cable television franchise fees health insurance lost ID fee IBID payments and off-track betting fees as well as fees for Building and Zoning Environmental. All other Cook County home rule taxes will continue to be administered outside the portal.

The Cook County Board today approved an amendment that would lower the tax rate for many individuals who park in garages and lots. Massachusetts Statewide Public Records. Cook county property tax portal.

The Cook County Property Tax Portal is the result of collaboration among the elected officials who take part in the property tax system. The Parking Tax applies to businesses that operate parking lots which must collect the tax from customers and remit to the City of Chicago. Search for felony or misdemeanor criminal charges by requesting records from the Massachusetts state repository.

18 for daily parking on the weekends. Wed 07172013 - 1200. COOK COUNTY PARKING LOT AND GARAGE OPERATIONS TAX From the Government Affairs Committee.

Access arrest records directly from Massachusetts law enforcement agencies individually. For more information about Personal Property and your filing responsibilities please use the Personal Property and Personal Property FAQS links on the left side of this page. The PIN is used for assessments tax rate calculations and tax collections.

NEW 1182021 - Firearm and Firearm Ammunition Tax must be collected beginning November 15 2021 On November 4 2021 the Cook County Board of Commissioners amended the Firearm and Firearm Ammunition Tax Ordinance to address the uniformity concerns expressed by the Illinois Supreme Court in the Guns Save Life ruling. If your business is subject to any of the following taxes you must use the portal. Effective september 1 2013 the cook county board of commissioners approved a change to the structure of the parking tax imposed upon the use and privilege of parking a motor vehicle in.

Parking lot and garage operations. This change is the result in a state law passed this year that. Duties and Responsibilities of the Cook County Treasurer.

Maria Pappas Cook County Treasurers Biography. Once you search by PIN you can pay your current bill online or learn additional ways to pay by clicking More Tax Bill Information on the next page. If you have any questions or concerns please contact the City of Boston Personal Property unit at 617 635.

1 amusement tax 2 alcoholic beverage tax 3 gasoline and diesel fuel tax 4 hotel accommodations tax and 5 parking lot and garage operations tax. The Portal consolidates information and delivers Cook County taxpayers a one-stop customer service website. Employers Expense Tax Head Tax.

Effective september 1 2013 the cook county board of commissioners approved a change to the structure of the parking tax. The Cook County Treasurers Office website was designed to meet the Illinois Information Technology Accessibility Act and the Americans with Disabilities Act. The cook county assessor sets the taxable value on all of the more than 18 million parcels of real estate located in cook county.

03082022 1000 AM 04062022 1000 AM 2211-02089. Cook county parking tax portal.

![]()

Crestwood Police Department Village Of Crestwood

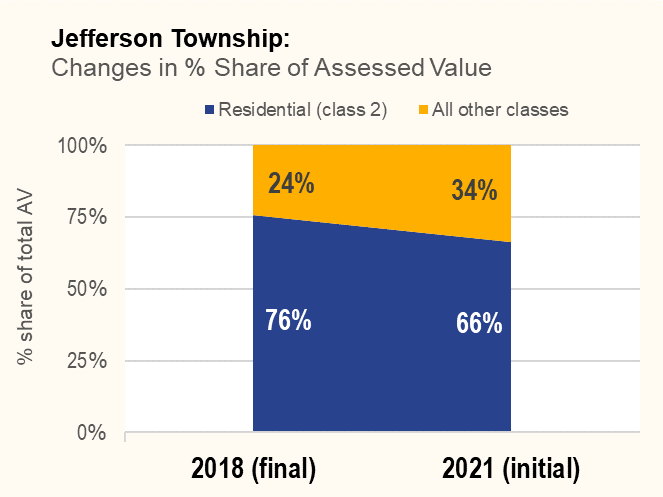

Jefferson Township Valuation Reports 2021 Cook County Assessor S Office

News Flash City Of Lenoir Nc Civicengage

![]()

Crestwood Police Department Village Of Crestwood

![]()

Crestwood Police Department Village Of Crestwood

.png)

Economic Assistance And Health Care Programs

Busse Road Improvement Study By Cook County Village Of Mount Prospect Il

![]()

Crestwood Police Department Village Of Crestwood

![]()

Crestwood Police Department Village Of Crestwood

Busse Road Improvement Study By Cook County Village Of Mount Prospect Il

The Mill On Main Mixes Modern Urban Living With Small Town Charm Tri W News Urban Living Resort Style Pool Small Towns

City Of Berwyn Berwyn 2021 2022 City Vehicle Stickers On Line Purchase Portal Opens Today West Cook News

![]()

Crestwood Police Department Village Of Crestwood

Busse Road Improvement Study By Cook County Village Of Mount Prospect Il